Navigating Difficult Conversations: A Practical Guide for Leaders

Ever delayed a tough conversation at work, whether about poor performance, strained team dynamics, or sensitive feedback, because you feared making things worse? You’re not alone.

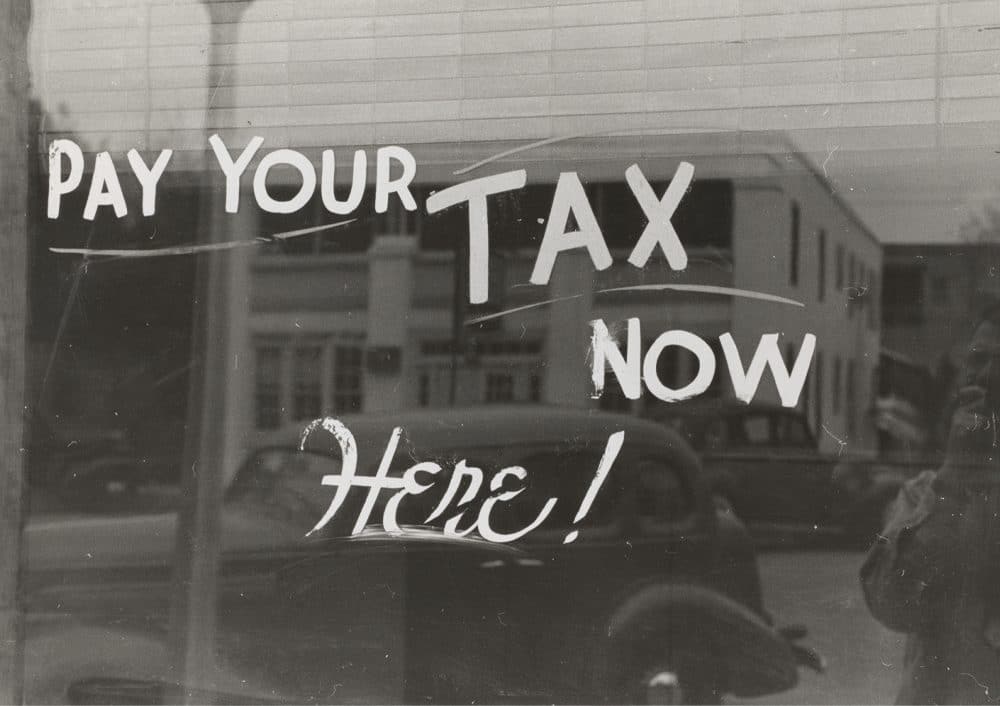

Single Touch Payroll (STP) is described as the biggest tax change since the introduction of GST. It is also referred to as real-time payroll reporting — because it means every time a business pays it’s workers, all salary information is sent to the ATO.

This reporting is generally done through your digital software systems and you should speak to your provider to ensure you are compliant. Technically companies with more than 20 employees were required to be STP compliant by 1 July 2018, however the ATO did grant extensions to some payroll providers. All companies should be STP Compliant by 1 July 2019 and they have until 31 July to ensure all details are uploaded to the tax office.

The legislation extended to companies with less than 19 employees, who should be compliant by 1 July 2019. The ATO have confirmed they will be taking a “soft touch” approach to compliance for micro businesses.

If you are compliant, your employees will not receive a PAYG Payment Summary this year. The information will be found in myGov as an “income statement”. The ATO will send employees information to advise when their income statement is tax ready.

You will need to advise your employees:

If you have any questions regarding STP, you should contact your payroll software provider to check that they are compliant and confirm the information you will need to send to employees.

“Single Touch Payroll (STP) is described as the biggest tax change since the introduction of GST. ”

Everything you need to know.

Ever delayed a tough conversation at work, whether about poor performance, strained team dynamics, or sensitive feedback, because you feared making things worse? You’re not alone.

End-of-year stress is inevitable, burnout isn’t. When leaders protect psychosocial safety, teams can finish strong without sacrificing wellbeing.

Let’s talk Pay Transparency. What it looks like and why it matters.

The ultimate HR eBook to benefit every business. Click here to learn more, or download the eBook for free using the form below.

Perform HR has teamed up with Madison & Marcus, a highly respected and influential employment law firm, to offer our clients the best possible employment and safety advice. Our proactive and practical approach ensures that you receive professional guidance that is tailored to your specific needs. Trust us to keep your business protected and compliant with the latest laws and regulations.

© 2026 performHR. All rights reserved. Privacy Policy | Sitemap.

"*" indicates required fields